Hiring Accountants for Beginners

Hiring Accountants for Beginners

Blog Article

Some Known Facts About Hiring Accountants.

Table of ContentsEverything about Hiring AccountantsHiring Accountants - TruthsAll About Hiring AccountantsNot known Incorrect Statements About Hiring Accountants What Does Hiring Accountants Mean?

Working with a pay-roll accounting professional comes with a set of financial dedications. Contracting out typically includes a set charge or a charge based upon the number of workers and the intricacy of your payroll requires. Depending on the size of your company and the services you require, the cost will vary. While this is another price to include to your overhead, a payroll accountant can soon end up spending for themselves.While you do not obtain somebody functioning entirely for your team, outsourcing also has great deals of its very own advantages. It is frequently a much more cost-effective solution than hiring somebody in-house, particularly for little to medium-sized enterprises (SMEs) that might not require a permanent pay-roll supervisor - Hiring Accountants. Costs here can vary from a few hundred to several thousand pounds annually, depending on the level of service required

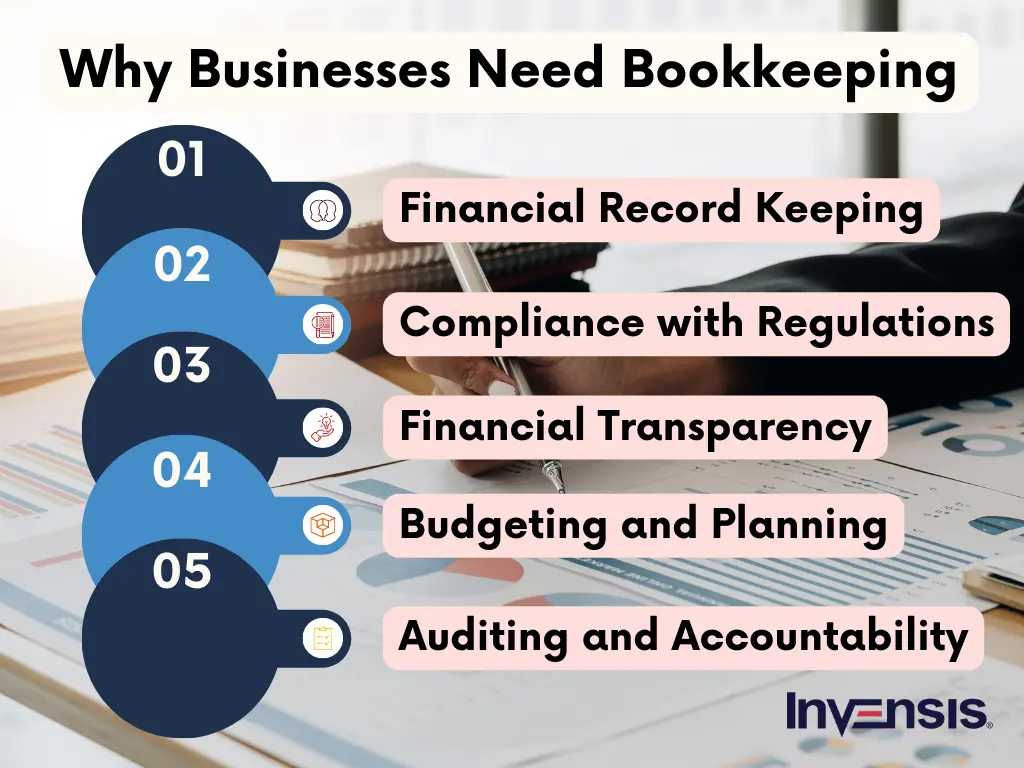

The UK's tax obligation system, particularly payroll taxes, is intricate and based on frequent changes. A payroll accounting professional makes certain that your service remains certified with HM Revenue and Personalizeds (HMRC) laws, thus staying clear of prospective fines and legal concerns. The satisfaction and protection this offers can be invaluable. This can also help to conserve you money in the future.

8 Easy Facts About Hiring Accountants Explained

The moment spent by business proprietors or other personnel on payroll can be substantial. If you function out the hourly pay for a senior participant of team and accumulate the time they are spending on pay-roll management, it usually can be a lot greater than the expense of outsourcing.

This critical input can result in significant expense savings and performance gains in time. This is where this expert recommendations truly enters its very own and can provide significant benefits. Simply having a professional sight and somebody to discuss your payroll with you can lead to a lot far better decision-making and a much more enlightened process.

Purchasing a payroll accountant or service can save organizations cash in the future. By guaranteeing conformity, preventing penalties, saving time, and giving tactical insights, the cost of employing a payroll accounting professional can be countered by the economic and non-financial advantages they bring. While the very first time period may cost greater than you obtain, you can be confident that what you are doing is benefitting your service, aiding it expand, and worth every cent.

How Hiring Accountants can Save You Time, Stress, and Money.

Scott Park, CERTIFIED PUBLIC ACCOUNTANT, CAFor most businesses, there comes a factor when it's time to hire a professional to deal with the monetary function of your company operations (Hiring Accountants). If you go to this point in your business, then congratulations! You have actually grown your company to the phase where you should be handing off some of those hats you put on as a company owner

If you're not an accountant exactly how will you recognize if you're asking the best accountancy specific inquiries? For almost every service out there these days, it appears that one of the greatest challenges is finding, hiring, and training brand-new employees.

By outsourcing your bookkeeping, you're not just getting someone's proficiency. You're obtaining the cumulative brain-power of the whole audit firm. You're getting the history and ability collection of their team, which is a very useful resource other of understanding. This definitely can be found in helpful when you face a particularly challenging or phenomenal scenario with your company.

This will prevent unnecessary rate of interest and penalty fees that might occur when points are missed or submitted late. A CPA audit firm is required to keep a certain degree of professional growth and they will be up to day on the most current tax obligation changes that take place each year.

The 10-Minute Rule for Hiring Accountants

These blog site articles ought to not be thought about details guidance considering that each individual's individual economic scenario is one-of-a-kind and fact particular. Numerous companies obtain to a place in their growth where they need someone to manage the firm funds. There can be benefits and drawbacks to each and what you decide will ultimately depend on your details business demands and goals.

All about Hiring Accountants

As we pointed out, sometimes, there are slow-moving periods in an accountancy division. When tax obligation season mores than, the audit department reduces considerably. During these sluggish times, an internal accounting professional will certainly still be on wage and entering the workplace every day. When you work with a bookkeeping firm, it may be a higher hourly rate, however when there's no work to do, there are no expenses for solution.

You'll require to pay for the software needed for an internal accountant to complete their job in addition to the furniture and materials for their work area. A bookkeeping firm will already have all these programs, and they'll always have the most up to date memberships of the most desired software application. Their group will be effectively straight from the source educated and will get any type of required training on all upgraded software.

Report this page